BayCom Corp

$ 29.40

-2.13%

27 Feb - close price

- Market Cap 320,394,000 USD

- Current Price $ 29.40

- High / Low $ 30.06 / 29.29

- Stock P/E 13.49

- Book Value 31.31

- EPS 2.18

- Next Earning Report 2026-04-16

- Dividend Per Share $0.90

- Dividend Yield 3 %

- Next Dividend Date 2026-04-09

- ROA 0.01 %

- ROE 0.07 %

- 52 Week High 33.15

- 52 Week Low 21.66

About

BayCom Corp is the banking holding company for United Business Bank providing various financial services to businesses, business owners and individuals. The company is headquartered in Walnut Creek, California.

Analyst Target Price

$32.50

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-01-22 | 2025-10-16 | 2025-07-17 | 2025-04-17 | 2025-01-23 | 2024-10-17 | 2024-07-18 | 2024-04-18 | 2024-01-25 | 2023-10-19 | 2023-07-26 | 2023-04-20 |

| Reported EPS | 0.63 | 0.46 | 0.58 | 0.51 | 0.55 | 0.54 | 0.5 | 0.51 | 0.55 | 0.56 | 0.59 | 0.55 |

| Estimated EPS | 0.65 | 0.52 | 0.55 | 0.52 | 0.51 | 0.51 | 0.48 | 0.56 | 0.57 | 0.53 | 0.53 | 0.58 |

| Surprise | -0.02 | -0.06 | 0.03 | -0.01 | 0.04 | 0.03 | 0.02 | -0.05 | -0.02 | 0.03 | 0.06 | -0.03 |

| Surprise Percentage | -3.0769% | -11.5385% | 5.4545% | -1.9231% | 7.8431% | 5.8824% | 4.1667% | -8.9286% | -3.5088% | 5.6604% | 11.3208% | -5.1724% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-16 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.62 |

| Currency | USD |

Previous Dividend Records

| Apr 2026 | Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-04-09 | 2026-01-09 | 2025-10-09 | 2025-07-10 | 2025-04-10 | 2025-01-10 | 2024-10-10 | 2024-07-11 | 2024-04-12 | 2024-01-12 |

| Amount | $0.3 | $0.3 | $0.25 | $0.2 | $0.15 | $0.15 | $0.1 | $0.1 | $0.1 | $0.1 |

Next Dividend Records

| Dividend per share (year): | $0.90 |

| Dividend Yield | 3% |

| Next Dividend Date | 2026-04-09 |

| Ex-Dividend Date | 2026-03-12 |

Recent News: BCML

2026-02-23 10:52:00

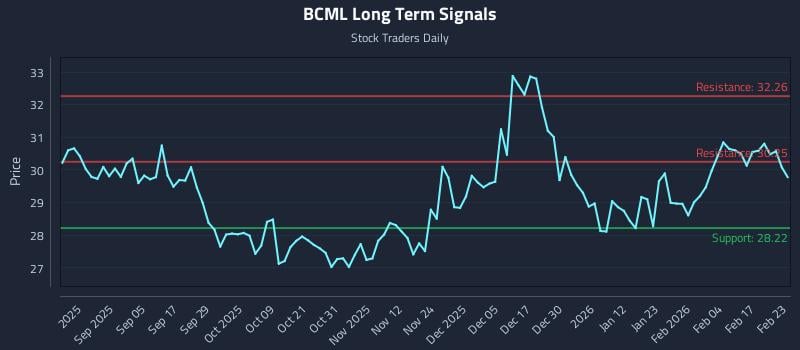

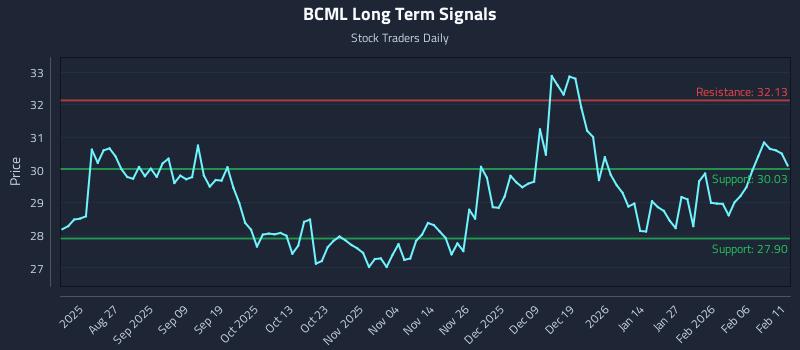

This article provides an in-depth AI-driven analysis for Baycom Corp (NASDAQ: BCML), focusing on trading strategies based on technical signals rather than market narratives. It highlights weak near-term sentiment but strong mid and long-term outlooks, offering specific entry, target, and stop-loss levels for position, momentum, and risk-hedging strategies. The analysis incorporates a 22.6:1 risk-reward short setup and multi-timeframe signal analysis to guide traders.

2026-02-19 21:52:49

BayCom Corp announced a quarterly cash dividend of $0.30 per share on its common stock, payable on April 9, 2026, to shareholders of record as of March 12, 2026. The company, through United Business Bank, offers various financial products and services across multiple states. This announcement follows recent financial reports, including their Q4 2025 earnings.

2026-02-19 18:59:00

BayCom Corp announced that it will maintain its quarterly cash dividend at $0.30 per share. The dividend is scheduled to be paid on April 9, 2026, to shareholders who are on record as of March 12, 2026. This decision follows recent financial reports where BayCom delivered increased earnings and revenue for Q4 2025.

2026-02-12 09:24:00

Baycom Corp (NASDAQ: BCML) is showing near-term neutral sentiment, indicating a potential stall despite mid and long-term strength. The stock is currently testing support, with a significant 23.3:1 risk-reward setup targeting a 7.0% gain against a 0.3% risk. AI-generated trading strategies are provided for different risk profiles, including long, breakout, and short positions, alongside multi-timeframe signal analysis.

2026-02-10 21:57:36

Investors should monitor BayCom Corp (BCML) due to high implied volatility in its stock options, notably the Feb. 20, 2026 $25.00 Put. This high volatility suggests market expectations of a significant price movement, possibly driven by upcoming events. Analysts currently rate BayCom as a Zacks Rank #2 (Buy), with recent positive revisions to earnings estimates, indicating a potential trading opportunity for options traders.

2026-02-10 15:57:57

Implied volatility for BayCom Corp (BCML) stock options is surging, particularly for the Feb. 20, 2026 $25.00 Put, indicating expectations of a significant price movement. Analysts currently rate BayCom as a Zacks Rank #2 (Buy), with earnings estimates increasing. This high implied volatility suggests a potential trading opportunity, often used by options traders to sell premium.