A10 Network

$ 18.99

0.26%

24 Feb - close price

- Market Cap 1,362,086,000 USD

- Current Price $ 18.99

- High / Low $ 19.49 / 18.90

- Stock P/E 33.32

- Book Value 2.96

- EPS 0.57

- Next Earning Report 2026-05-05

- Dividend Per Share $0.24

- Dividend Yield 1.27 %

- Next Dividend Date 2026-03-02

- ROA 0.06 %

- ROE 0.19 %

- 52 Week High 21.25

- 52 Week Low 13.63

About

A10 Networks, Inc. offers network solutions in the United States, Japan, other Asia Pacific countries, and EMEA. The company is headquartered in San Jose, California.

Analyst Target Price

$24.33

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-04 | 2025-11-06 | 2025-08-05 | 2025-05-01 | 2025-02-04 | 2024-11-07 | 2024-07-30 | 2024-04-30 | 2024-02-06 | 2023-11-07 | 2023-07-26 | 2023-05-04 |

| Reported EPS | 0.26 | 0.23 | 0.21 | 0.2 | 0.31 | 0.21 | 0.18 | 0.17 | 0.25 | 0.16 | 0.19 | 0.13 |

| Estimated EPS | 0.24 | 0.21 | 0.2 | 0.18 | 0.22 | 0.19 | 0.17 | 0.15 | 0.26 | 0.14 | 0.17 | 0.14 |

| Surprise | 0.02 | 0.02 | 0.01 | 0.02 | 0.09 | 0.02 | 0.01 | 0.02 | -0.01 | 0.02 | 0.02 | -0.01 |

| Surprise Percentage | 8.3333% | 9.5238% | 5% | 11.1111% | 40.9091% | 10.5263% | 5.8824% | 13.3333% | -3.8462% | 14.2857% | 11.7647% | -7.1429% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-05-05 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.2127 |

| Currency | USD |

Previous Dividend Records

| Mar 2026 | Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-03-02 | 2025-12-01 | 2025-09-02 | 2025-06-02 | 2025-03-03 | 2024-12-02 | 2024-09-03 | 2024-06-03 | 2024-03-01 | 2023-12-01 |

| Amount | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 | $0.06 |

Next Dividend Records

| Dividend per share (year): | $0.24 |

| Dividend Yield | 1.27% |

| Next Dividend Date | 2026-03-02 |

| Ex-Dividend Date | 2026-02-13 |

Recent News: ATEN

2026-02-24 14:53:42

A10 Networks (ATEN) closed at $18.94 and Wall Street analysts expect a potential rally of 28.83%, with a mean price target of $24.4. While analyst price targets can be misleading, the stock's potential upside is also supported by increasing optimism among analysts regarding the company's earnings prospects and its Zacks Rank #2 (Buy) rating. Investors should consider price targets with skepticism but recognize the correlation between earnings estimate revisions and stock price movements.

2026-02-23 09:35:31

A10 Networks (NYSE:ATEN) has announced a new capital allocation plan that focuses on potential acquisitions in next-generation networking and security, alongside returning capital to shareholders. The company aims to prioritize organic growth while pursuing strategic acquisitions. This plan provides insight into how management intends to balance growth, acquisitions, and shareholder returns, especially as the stock has shown positive recent performance, although it is still below analyst targets and Simply Wall St's fair value estimate.

2026-02-23 07:40:53

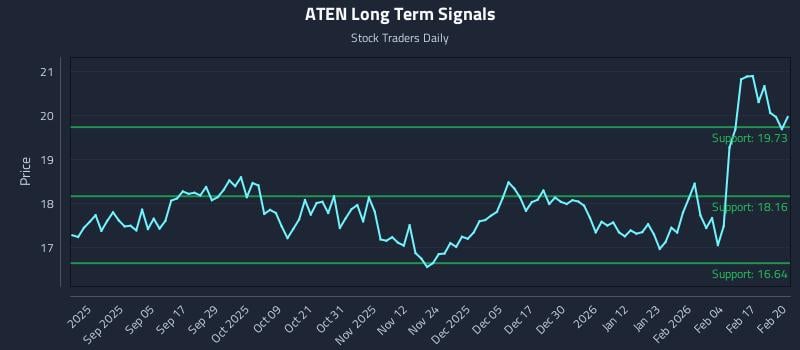

This article analyzes A10 Networks Inc. (NASDAQ: ATEN), identifying conflicting sentiment across time horizons and suggesting choppy market conditions. It highlights elevated downside risk and provides AI-generated institutional trading strategies for long, breakout, and short positions, including entry zones, targets, and stop losses. The analysis also includes multi-timeframe signal strength, support, and resistance levels for the stock.

2026-02-21 22:56:00

A10 Networks hosted over 100 partners from 23 countries at its Affinity Partner Summit in Antalya, Turkey, emphasizing business and technology innovation. The company unveiled new solutions like the A10 Next-Gen WAF, powered by Fastly, and discussed strategies for channel growth and cybersecurity. The event highlighted customer successes in defending against DDoS attacks and optimizing security infrastructure, underscoring A10's commitment to strengthening its partner ecosystem.

2026-02-20 21:29:02

Four analysts have recently provided projections for A10 Networks (NYSE: ATEN), with an average price target of $23.75, representing a 5.56% increase from the prior average. The company's financials show strong profitability with a 12.28% net margin and robust asset management, although its revenue growth lags behind industry peers. Analysts' current ratings collectively lean bullish, with some raising price targets.

2026-02-20 19:52:22

BWS Financial has raised its price target for A10 Networks (ATEN) to $28.00, maintaining a Buy rating. This adjustment follows other recent analyst activity, including BTIG reiterating a Buy rating with a $22.00 target and Deutsche Bank initiating coverage with a Buy rating and $22.00 target. The average one-year price target from six analysts is currently $23.50, implying an upside of 17.85% from the current price.