Arhaus Inc

$ 10.81

-2.17%

16 Jan - close price

- Market Cap 1,524,897,000 USD

- Current Price $ 10.81

- High / Low $ 11.18 / 10.76

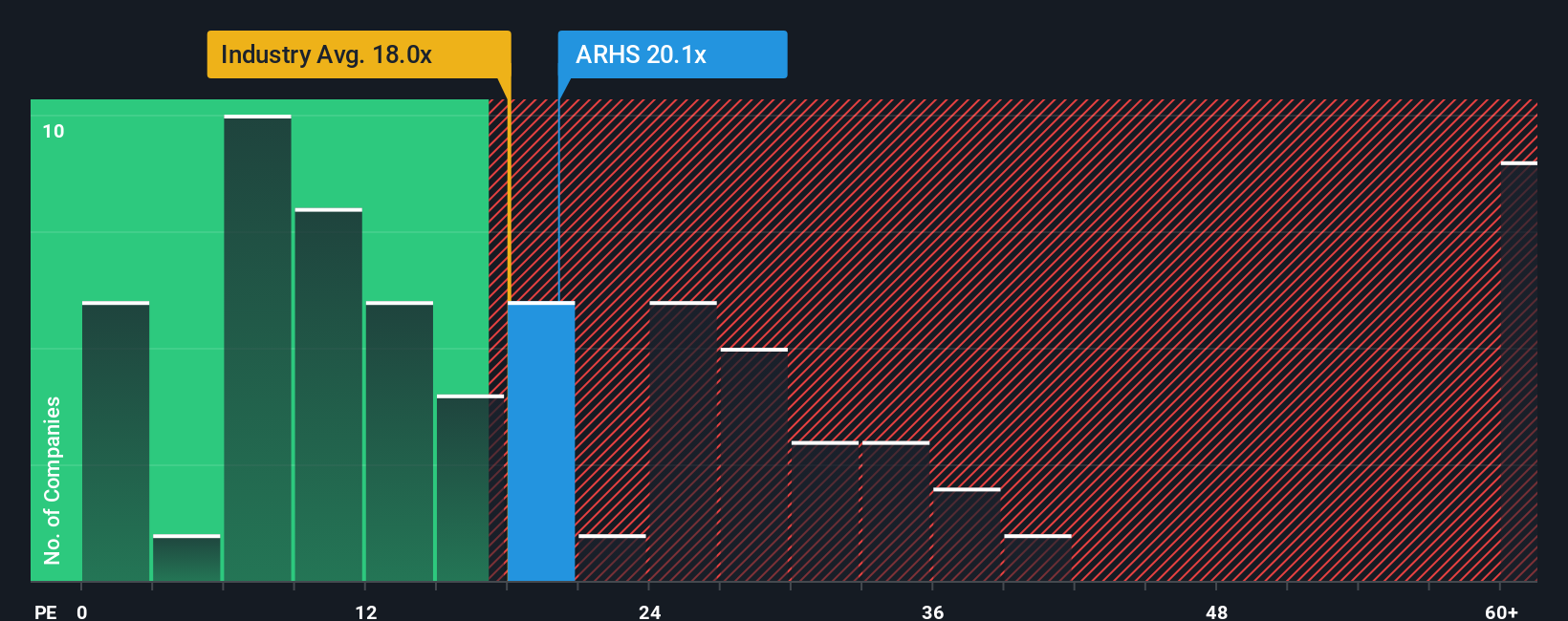

- Stock P/E 20.79

- Book Value 2.84

- EPS 0.52

- Next Earning Report 2026-02-25

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.05 %

- ROE 0.20 %

- 52 Week High 13.02

- 52 Week Low 6.61

About

None

Analyst Target Price

$11.50

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-07 | 2025-05-07 | 2025-03-05 | 2024-11-07 | 2024-08-08 | 2024-05-09 | 2024-03-07 | 2023-11-02 | 2023-08-09 | 2023-05-04 | 2023-03-09 |

| Reported EPS | 0.37 | 0.25 | 0.03 | 0.1453 | 0.07 | 0.16 | 0.11 | 0.22 | 0.14 | 0.29 | 0.25 | 0.34 |

| Estimated EPS | 0.08 | 0.15 | 0.0613 | 0.1223 | 0.08 | 0.12 | 0.02 | 0.16 | 0.12 | 0.26 | 0.2 | 0.2 |

| Surprise | 0.29 | 0.1 | -0.0313 | 0.023 | -0.01 | 0.04 | 0.09 | 0.06 | 0.02 | 0.03 | 0.05 | 0.14 |

| Surprise Percentage | 362.5% | 66.6667% | -51.0604% | 18.8062% | -12.5% | 33.3333% | 450% | 37.5% | 16.6667% | 11.5385% | 25% | 70% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-25 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.09 |

| Currency | USD |

Previous Dividend Records

| Apr 2024 | |

|---|---|

| Payment Date | 2024-04-04 |

| Amount | $0.5 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ARHS

2026-01-07 17:09:08

This article assesses Arhaus (ARHS) valuation following its recent share price movements and plans for showroom expansion. While the narrative suggests Arhaus is about 1.5% undervalued, an earnings multiple analysis indicates its current P/E of 21.2x is higher than a fair ratio of 13.6x. The analysis concludes that future performance hinges on successful showroom expansion and controlled costs, suggesting investors should consider if the current premium is justified.

2025-12-26 19:08:58

Harbor Capital Advisors Inc. significantly reduced its stake in Arhaus, Inc. (NASDAQ:ARHS) by 71.2% in the third quarter of 2025, selling 472,806 shares and retaining 191,101 shares valued at approximately $2.03 million. Despite this, other institutional investors increased their holdings, and Arhaus beat Q3 earnings estimates. The company currently holds an average "Hold" rating from analysts with a consensus target price of $11.11.

2025-12-23 13:00:00

Arhaus (NASDAQ: ARHS) has announced the opening of its second San Diego showroom, an approximately 19,900-square-foot space located in the Fashion Valley Mall. This new location marks the 16th Arhaus showroom in California and reflects the brand's continued growth in the state. To celebrate the opening, Arhaus made a $10,000 contribution to American Forests, aligning with its commitment to sustainability and its Green Initiative.

2025-12-01 17:09:13

Arhaus, Inc. reported record-breaking Q3 2025 net revenue of $345 million, an 8% year-over-year increase, driven by strong demand and new product success. Despite an October demand decline and potential tariff impacts, the company maintains a robust financial position and is expanding its showroom presence. Arhaus projects full-year net revenue between $1.35 billion and $1.38 billion, emphasizing strategic growth and operational efficiency amidst a dynamic macro environment.

2025-11-28 18:09:37

Envestnet Asset Management Inc. significantly reduced its stake in Arhaus, Inc. (NASDAQ:ARHS) by 54.7% in the second quarter, ending with 34,942 shares valued at $303,000. Despite this reduction, Arhaus has reported strong quarterly earnings, beating analyst estimates with $0.09 EPS and $344.6 million in revenue, leading to an 8% year-over-year revenue growth. Analyst sentiment for Arhaus remains largely neutral with a consensus "Hold" rating and an average price target of $11.11.

2025-11-14 22:08:52

Arhaus, Inc. reported record third-quarter 2025 results with net revenue up 8.0% year-over-year to $345 million, marking the highest third-quarter performance in the company's history. The company also saw increased profitability with net income rising 23.1% to $12 million and Adjusted EBITDA growing 35.2% to $31 million, driven by showroom expansion and strong product demand. Arhaus raised its full-year 2025 revenue outlook, maintaining a cautious but confident stance despite current economic uncertainties, emphasizing its strong liquidity and debt-free status.