Artisan Partners Asset Management Inc

$ 41.01

2.37%

25 Feb - close price

- Market Cap 2,889,633,000 USD

- Current Price $ 41.01

- High / Low $ 41.08 / 39.85

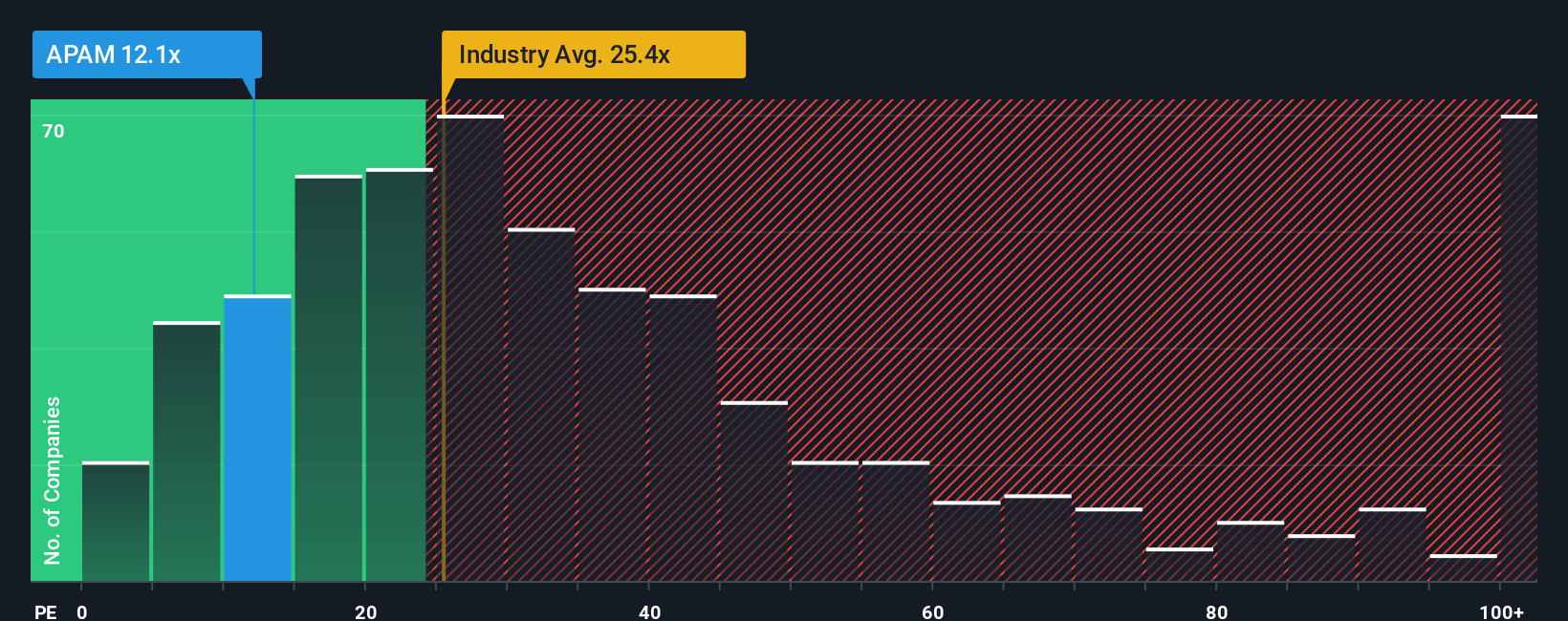

- Stock P/E 10.13

- Book Value 6.23

- EPS 4.05

- Next Earning Report -

- Dividend Per Share $3.30

- Dividend Yield 8.24 %

- Next Dividend Date -

- ROA 0.16 %

- ROE 0.49 %

- 52 Week High 45.10

- 52 Week Low 29.99

About

Artisan Partners Asset Management Inc. is a publicly owned investment manager. The company is headquartered in Milwaukee, Wisconsin with additional offices in Atlanta, Georgia; New York City; San Francisco, California; Leawood, Kansas; and London, United Kingdom.

Analyst Target Price

$42.75

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-12-31 | 2025-11-04 | 2025-07-29 | 2025-04-29 | 2025-02-04 | 2024-10-29 | 2024-07-23 | 2024-04-23 | 2024-01-30 | 2023-10-31 | 2023-08-01 | 2023-05-02 |

| Reported EPS | 1.26 | 1.02 | 0.83 | 0.83 | 1.05 | 0.92 | 0.82 | 0.76 | 0.78 | 0.75 | 0.71 | 0.64 |

| Estimated EPS | 1.0875 | 0.95 | 0.82 | 0.75 | 0.95 | 0.9 | 0.85 | 0.77 | 0.74 | 0.74 | 0.73 | 0.61 |

| Surprise | 0.1725 | 0.07 | 0.01 | 0.08 | 0.1 | 0.02 | -0.03 | -0.01 | 0.04 | 0.01 | -0.02 | 0.03 |

| Surprise Percentage | 15.8621% | 7.3684% | 1.2195% | 10.6667% | 10.5263% | 2.2222% | -3.5294% | -1.2987% | 5.4054% | 1.3514% | -2.7397% | 4.918% |

Next Quarterly Earnings

| Reported Date |

| Fiscal Date Ending |

| Estimated EPS |

| Currency |

Previous Dividend Records

| Feb 2026 | Nov 2025 | Aug 2025 | May 2025 | Feb 2025 | Nov 2024 | Aug 2024 | May 2024 | Feb 2024 | Nov 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-02-27 | 2025-11-28 | 2025-08-29 | 2025-05-30 | 2025-02-28 | 2024-11-29 | 2024-08-30 | 2024-05-31 | 2024-02-29 | 2023-11-30 |

| Amount | $1.58 | $0.88 | $0.73 | $0.68 | $1.34 | $0.82 | $0.71 | $0.61 | $1.02 | $0.65 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: APAM

2026-02-23 05:54:00

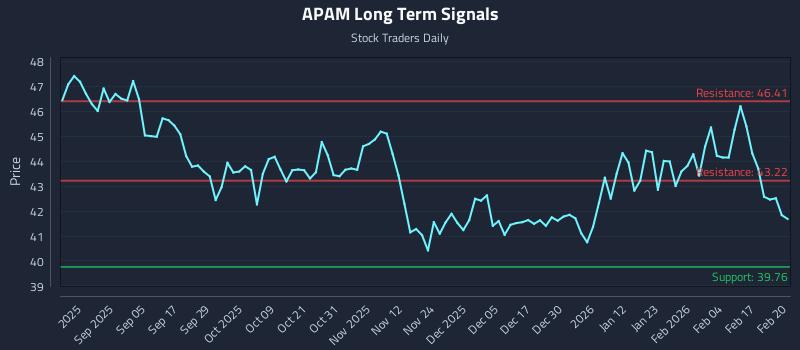

This article provides an analysis of Artisan Partners Asset Management Inc. Class A (NASDAQ: APAM), highlighting weak near-term sentiment but long-term strength. It details specific trading strategies including position trading, momentum breakout, and risk hedging, along with multi-timeframe signal analysis. The report also mentions an exceptional risk-reward short setup and offers access to real-time AI-generated signals for traders.

2026-02-18 19:09:06

Heartland Advisors Inc. significantly reduced its stake in Artisan Partners Asset Management Inc. (NYSE:APAM) by 82.6% in the third quarter, selling 101,671 shares and retaining 21,473 shares valued at approximately $932,000. Artisan Partners reported strong quarterly earnings, beating estimates with $1.26 EPS and $335.5 million in revenue, alongside declaring an annual dividend of $0.57 per share. Despite the share reduction by Heartland Advisors, institutional investors collectively own a substantial 86.45% of the company's stock.

2026-02-16 20:51:29

The Public Sector Pension Investment Board increased its stake in Artisan Partners Asset Management Inc. (APAM) by 12% during the third quarter, acquiring an additional 33,428 shares. This brings their total holding to 312,766 shares, valued at approximately $13.57 million. Artisan Partners recently reported strong quarterly earnings, beating expectations with an EPS of $1.26 and revenue of $335.5 million, an increase of 13% year-over-year.

2026-02-14 11:27:31

Artisan Partners Asset Management (NYSE:APAM) has appointed Ryan G. Von Hoff as Chief Accounting Officer, a move aimed at ensuring continuity and reliability in financial reporting. This internal promotion is significant for investors, especially given Artisan Partners' policy of distributing about 80% of quarterly cash generation as dividends. The new CAO's role will be critical in maintaining transparency regarding variable dividends and other financial disclosures, which are key for shareholder confidence and assessing the company's financial health and growth prospects.

2026-02-13 00:57:51

Artisan Partners (APAM) has reported strong Q4 and full-year 2025 results, including a combined dividend of US$1.58 per share. While the company's share price has seen long-term momentum, its current trading price of US$44.27 is slightly above the narrative's fair value of US$43.25, suggesting it may be modestly overvalued according to one analytical model. However, its P/E ratio of 10.7x is lower than the fair ratio of 13.9x and a peer average of 15x, indicating potential undervaluation from a multiples perspective.

2026-02-12 04:26:00

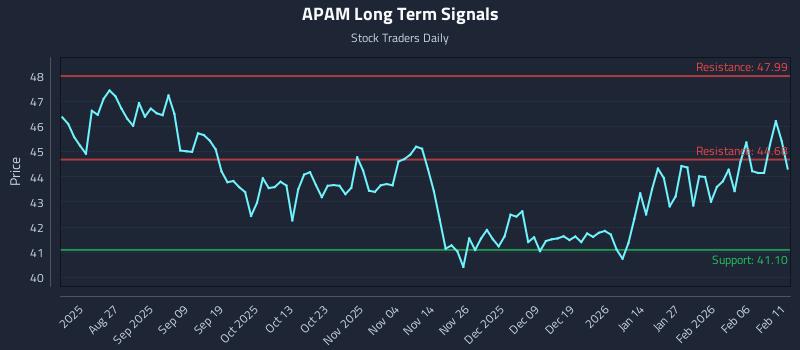

This article provides an in-depth analysis of Artisan Partners Asset Management Inc. Class A (NASDAQ: APAM), focusing on its liquidity pulse for institutional tactics. It highlights strong sentiment supporting an overweight bias, outlines institutional trading strategies including position trading, momentum breakout, and risk hedging, and presents multi-timeframe signal analysis generated by AI models. The report also details entry zones, targets, and stop losses for different risk profiles.