Alpha Metallurgical Resources Inc

$ 180.63

2.17%

24 Feb - close price

- Market Cap 2,307,785,000 USD

- Current Price $ 180.63

- High / Low $ 183.80 / 174.69

- Stock P/E N/A

- Book Value 123.24

- EPS -3.59

- Next Earning Report 2026-02-27

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA -0.01 %

- ROE -0.03 %

- 52 Week High 253.82

- 52 Week Low 97.41

About

Alpha Metallurgical Resources, Inc. is a mining company. The company is headquartered in Bristol, Tennessee.

Analyst Target Price

$204.00

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-30 | 2025-08-08 | 2025-05-05 | 2025-02-24 | 2024-11-01 | 2024-08-05 | 2024-05-06 | 2024-02-26 | 2023-11-02 | 2023-08-04 | 2023-05-08 | 2023-02-23 |

| Reported EPS | -0.3157 | -0.38 | -2.6 | -0.16 | 0.29 | 4.49 | 9.59 | 13.06 | 6.65 | 12.16 | 17.01 | 13.37 |

| Estimated EPS | 0.2533 | -2.04 | -1.06 | -0.16 | 1.03 | 4.46 | 10.83 | 9.07 | 6.46 | 12.69 | 14.13 | 15.07 |

| Surprise | -0.569 | 1.66 | -1.54 | 0 | -0.74 | 0.03 | -1.24 | 3.99 | 0.19 | -0.53 | 2.88 | -1.7 |

| Surprise Percentage | -224.6348% | 81.3725% | -145.283% | 0% | -71.8447% | 0.6726% | -11.4497% | 43.9912% | 2.9412% | -4.1765% | 20.3822% | -11.2807% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-27 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | -1.34 |

| Currency | USD |

Previous Dividend Records

| Dec 2023 | Oct 2023 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|

| Payment Date | 2023-12-15 | 2023-10-03 | None | None | None | None | None |

| Amount | $0.5 | $0.5 | $0.5 | $0.44 | $5.418 | $0.392 | $0.375 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: AMR

2026-02-23 05:24:27

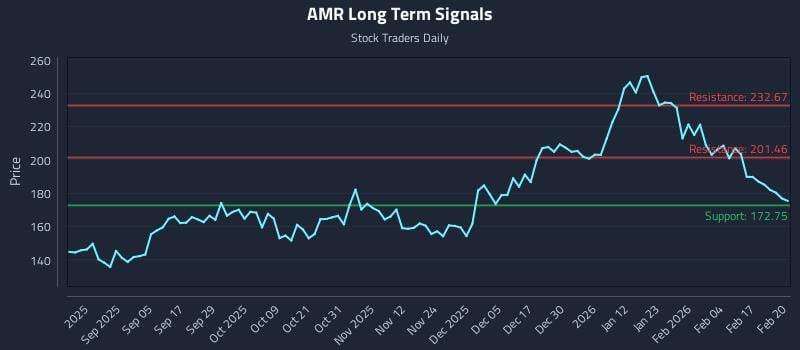

This article provides a price-driven insight for Alpha Metallurgical Resources Inc. (AMR), highlighting weak near and mid-term sentiment but a strong long-term outlook. It details three AI-generated trading strategies—Position Trading, Momentum Breakout, and Risk Hedging—along with specific entry, target, and stop-loss levels. The analysis also includes multi-timeframe signal analysis indicating support and resistance levels.

2026-02-21 13:44:00

Towle & Co. reduced its stake in Alpha Metallurgical Resources (NYSE:AMR) by 16.9% in Q3, selling 12,955 shares and retaining 63,789 shares valued at approximately $10.47 million. The company's stock has a "Reduce" consensus rating from Wall Street analysts, with an average target price of $204. Insider activity includes significant purchases and sales, with insiders owning 16% of the company, while institutional investors hold around 84.3%.

2026-02-21 03:59:44

Alpha Metallurgical Resources, Inc. (AMR) released its 2024 10-K report, highlighting a 14.8% decrease in revenues to $2,957 million and a net income of $188 million, down from $722 million in the prior year. The company produced 14.6 million tons of met coal and 1.1 million tons of thermal coal, while initiating development of the Kingston Wildcat underground mine and temporarily idling the Elk Run mining complex. Alpha faces challenges from market fluctuations, regulatory changes, and environmental concerns, and plans to address these through strategic investments, efficiency improvements, and enhanced ESG practices.

2026-02-20 15:44:00

Alpha Metallurgical Resources (AMR) is set to release its Q4 2025 earnings before market open on Friday, February 27th, with analysts forecasting an EPS of $0.54 and revenue of $538.45 million. The stock currently has a "Reduce" consensus rating and an average target price of $204.00, despite recent insider buying activity totaling approximately $18 million.

2026-02-15 21:27:37

Alpha Metallurgical Resources has committed to supplying approximately 3.6 million tons of metallurgical coal to domestic customers for the 2026 calendar year at an average price of $136.75 per ton. CEO Andy Eidson indicated satisfaction with the current commitments and openness to contracting additional tonnage if needed. The company, based in Tennessee, supplies metallurgical products globally to the steel industry and emphasizes its financial resilience and conservative capital allocation strategy.

2026-02-14 19:27:29

Alpha Metallurgical Resources (NYSE:AMR) shares have experienced a significant 26% drop over the last month, despite a 10% gain over the past year. This decline has led to a low price-to-sales (P/S) ratio of 1.1x, which is considerably lower than the broader Metals and Mining industry average in the US. The company's recent revenue decline of 33% and a projected lower growth rate compared to the industry are seen as key reasons for the market's dampened sentiment and low valuation.