ADEIA CORP

$ 17.31

2.18%

29 Dec - close price

- Market Cap 1,895,621,000 USD

- Current Price $ 17.31

- High / Low $ 17.35 / 16.59

- Stock P/E 26.63

- Book Value 3.78

- EPS 0.65

- Next Earning Report 2026-02-17

- Dividend Per Share $0.20

- Dividend Yield 1.18 %

- Next Dividend Date -

- ROA 0.08 %

- ROE 0.18 %

- 52 Week High 18.17

- 52 Week Low 10.47

About

Adeia Corp is a prominent global licensing firm based in San Jose, California, renowned for its commitment to enhancing consumer and entertainment experiences through innovative technological solutions. Specializing in intellectual property and product licensing, the company collaborates with diverse industries to unlock growth and maximize value from its comprehensive portfolio. With a strong emphasis on innovation and a well-established licensing framework, Adeia is strategically positioned within the evolving entertainment sector, presenting an appealing opportunity for institutional investors looking to capitalize on advancements in technology and intellectual property.

Analyst Target Price

$22.75

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-03 | 2025-08-05 | 2025-05-05 | 2025-02-18 | 2024-11-07 | 2024-08-06 | 2024-05-06 | 2024-02-20 | 2023-11-06 | 2023-08-07 | 2023-05-08 | 2023-02-22 |

| Reported EPS | 0.28 | 0.25 | 0.26 | 0.47 | 0.27 | 0.28 | 0.25 | 0.27 | 0.38 | 0.26 | 0.48 | 0.41 |

| Estimated EPS | 0.33 | 0.26 | 0.2887 | 0.4263 | 0.39 | 0.23 | 0.21 | 0.25 | 0.26 | 0.25 | 0.33 | 0.3 |

| Surprise | -0.05 | -0.01 | -0.0287 | 0.0437 | -0.12 | 0.05 | 0.04 | 0.02 | 0.12 | 0.01 | 0.15 | 0.11 |

| Surprise Percentage | -15.1515% | -3.8462% | -9.9411% | 10.251% | -30.7692% | 21.7391% | 19.0476% | 8% | 46.1538% | 4% | 45.4545% | 36.6667% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-17 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.43 |

| Currency | USD |

Previous Dividend Records

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-12-15 | 2025-09-16 | 2025-06-17 | 2025-03-31 | 2024-12-18 | 2024-09-17 | 2024-06-18 | 2024-03-26 | 2023-12-18 | 2023-09-18 |

| Amount | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ADEA

2025-12-29 10:09:18

Adeia's stock surged 18% after the intellectual property licensing company announced a new agreement with The Walt Disney Company, resolving a previous lawsuit. This deal led Adeia to significantly raise its 2025 financial outlook, including revenue, non-GAAP net income, and adjusted EBITDA guidance. The agreement grants Disney access to Adeia's comprehensive media IP portfolio, further validating Adeia's technology in connected entertainment.

2025-12-23 15:18:04

Adeia (NASDAQ:ADEA) saw its stock rise 3.5% after Rosenblatt Securities increased its price target from $17 to $20, reiterating a "Buy" rating. This upgrade follows Adeia's new long-term media IP license agreement with The Walt Disney Company and a significant raise in its 2025 financial guidance. The company's updated outlook projects revenue between $425M–$435M and adjusted EBITDA of $257.1M–$265.1M, largely driven by the Disney deal.

2025-12-23 15:09:20

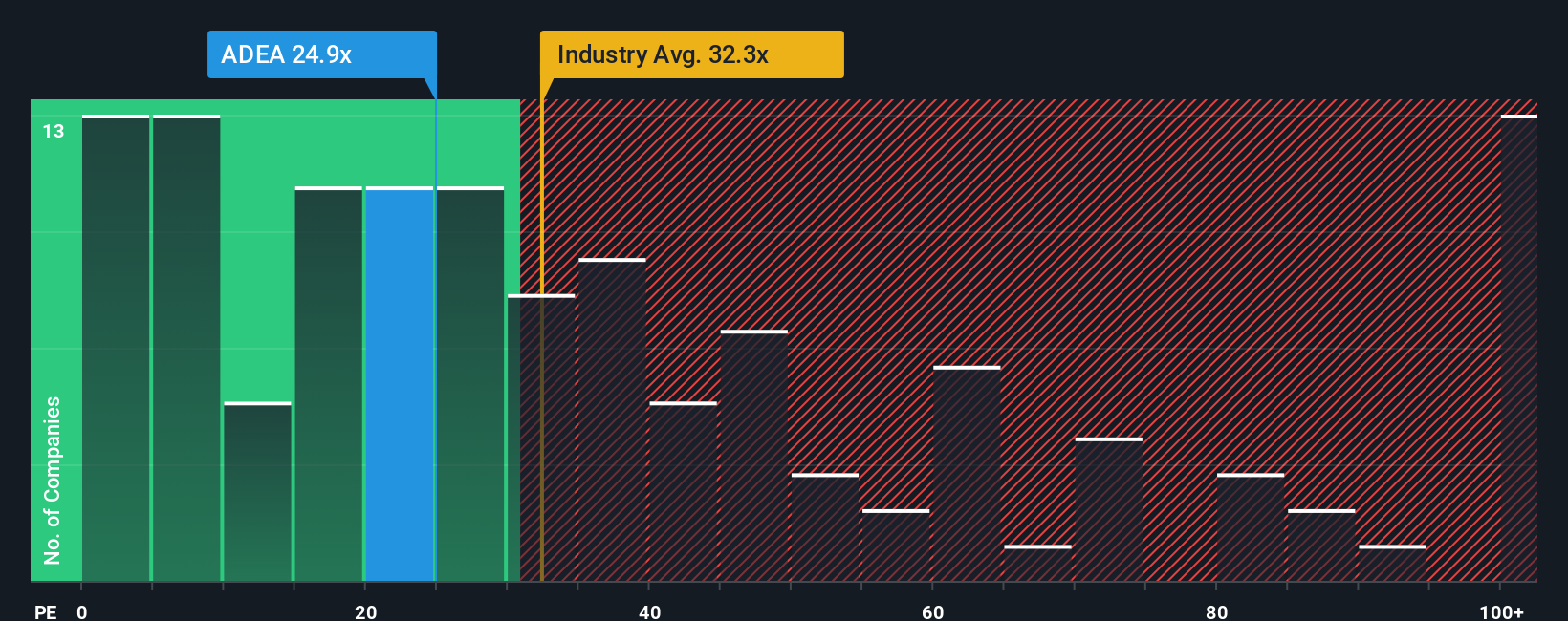

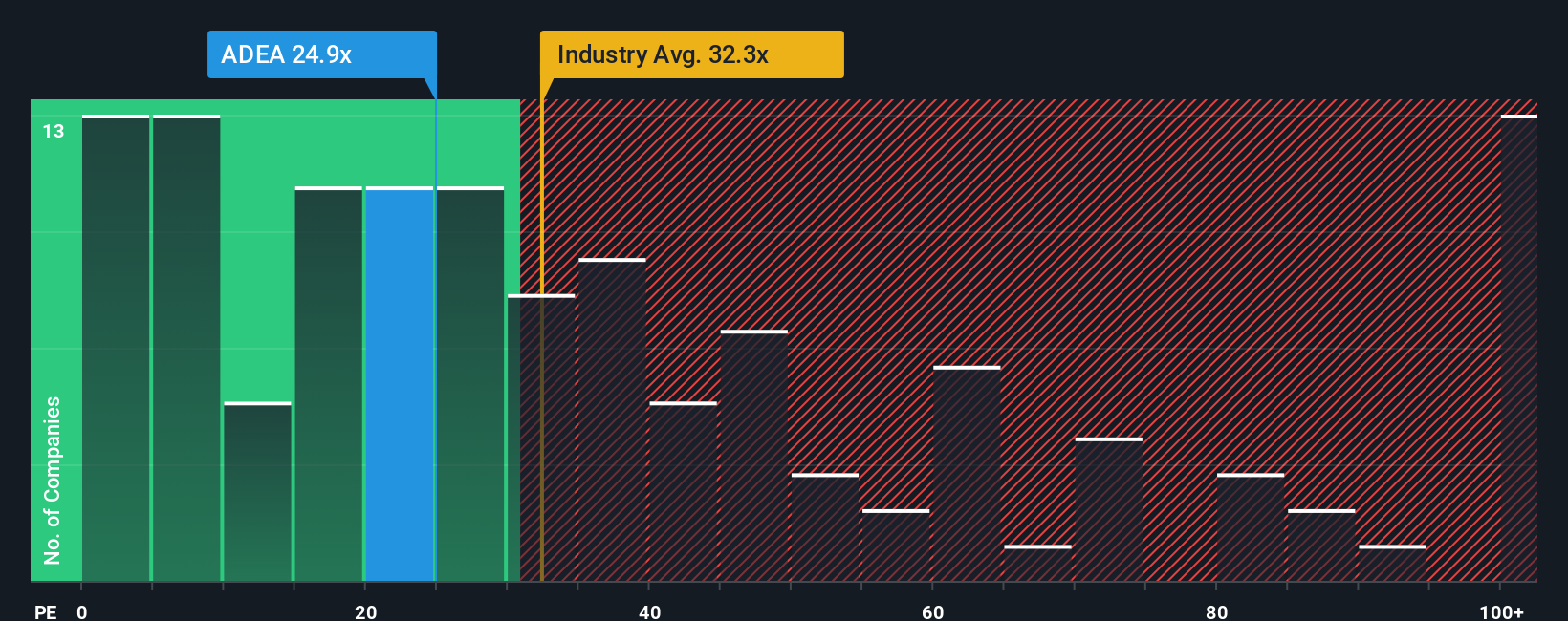

Adeia Inc. (NASDAQ:ADEA) shares have rallied 38% in the last month, contributing to a 22% annual gain, yet its high P/E ratio of 24.9x suggests potential overvaluation compared to the broader market. Despite recent strong earnings growth of 77%, past EPS declines and an analyst forecast of 11% growth (lower than the market average) raise concerns about the sustainability of its current share price. Investors may be overly optimistic, facing risks if earnings growth doesn't accelerate significantly.

2025-12-23 15:09:20

Assenagon Asset Management S.A. initiated a new position in Adeia Inc. (NASDAQ:ADEA) during the third quarter, acquiring 199,563 shares valued at approximately $3.35 million. This coincides with Adeia signing a long-term media IP license with Disney, significantly raising its 2025 revenue guidance, and prompting analyst price target upgrades. Despite high institutional ownership and positive sentiment from the Disney deal, Adeia recently missed revenue and EPS estimates, indicating potential execution and expense management risks.

2025-12-23 15:09:18

Adeia Inc. (NASDAQ:ADEA) shares have rebounded 38% in the last month, but the company's price-to-earnings (P/E) ratio of 24.9x, which is higher than most US companies, suggests potential overvaluation. Despite strong recent earnings growth of 77% last year, EPS has fallen 60% over three years, and future growth is projected at a modest 11%, lower than the broader market's 16%. This disparity between a high P/E and lower future growth forecasts raises concerns about the sustainability of its current valuation.

2025-12-23 15:09:04

Rosenblatt Securities has increased its price target for Adeia Inc. to $20 from $17, while reiterating a Buy rating on the stock. This adjustment follows Adeia's recent financial guidance updates and a new licensing agreement with Walt Disney. The company specializes in intellectual property licensing for various industries, including entertainment and semiconductors.