Acm Research Inc

$ 65.12

-2.21%

23 Feb - close price

- Market Cap 4,320,123,000 USD

- Current Price $ 65.12

- High / Low $ 67.30 / 62.87

- Stock P/E 38.72

- Book Value 22.08

- EPS 1.72

- Next Earning Report 2026-02-26

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.04 %

- ROE 0.10 %

- 52 Week High 71.65

- 52 Week Low 16.82

About

ACM Research, Inc. develops, manufactures and sells single wafer wet cleaning equipment to improve the manufacturing process and performance of embedded chips globally. The company is headquartered in Fremont, California.

Analyst Target Price

$51.87

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-05 | 2025-08-07 | 2025-05-06 | 2025-02-26 | 2024-11-07 | 2024-08-07 | 2024-05-08 | 2024-02-28 | 2023-11-07 | 2023-08-04 | 2023-05-05 | 2023-02-24 |

| Reported EPS | 0.36 | 0.44 | 0.46 | 0.56 | 0.63 | 0.55 | 0.52 | 0.43 | 0.57 | 0.48 | 0.15 | 0.19 |

| Estimated EPS | 0.55 | 0.4816 | 0.3475 | 0.3875 | 0.37 | 0.35 | 0.33 | 0.17 | 0.34 | 0.12 | 0.0808 | 0.14 |

| Surprise | -0.19 | -0.0416 | 0.1125 | 0.1725 | 0.26 | 0.2 | 0.19 | 0.26 | 0.23 | 0.36 | 0.0692 | 0.05 |

| Surprise Percentage | -34.5455% | -8.6379% | 32.3741% | 44.5161% | 70.2703% | 57.1429% | 57.5758% | 152.9412% | 67.6471% | 300% | 85.6436% | 35.7143% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-26 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.26 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ACMR

2026-02-16 07:27:39

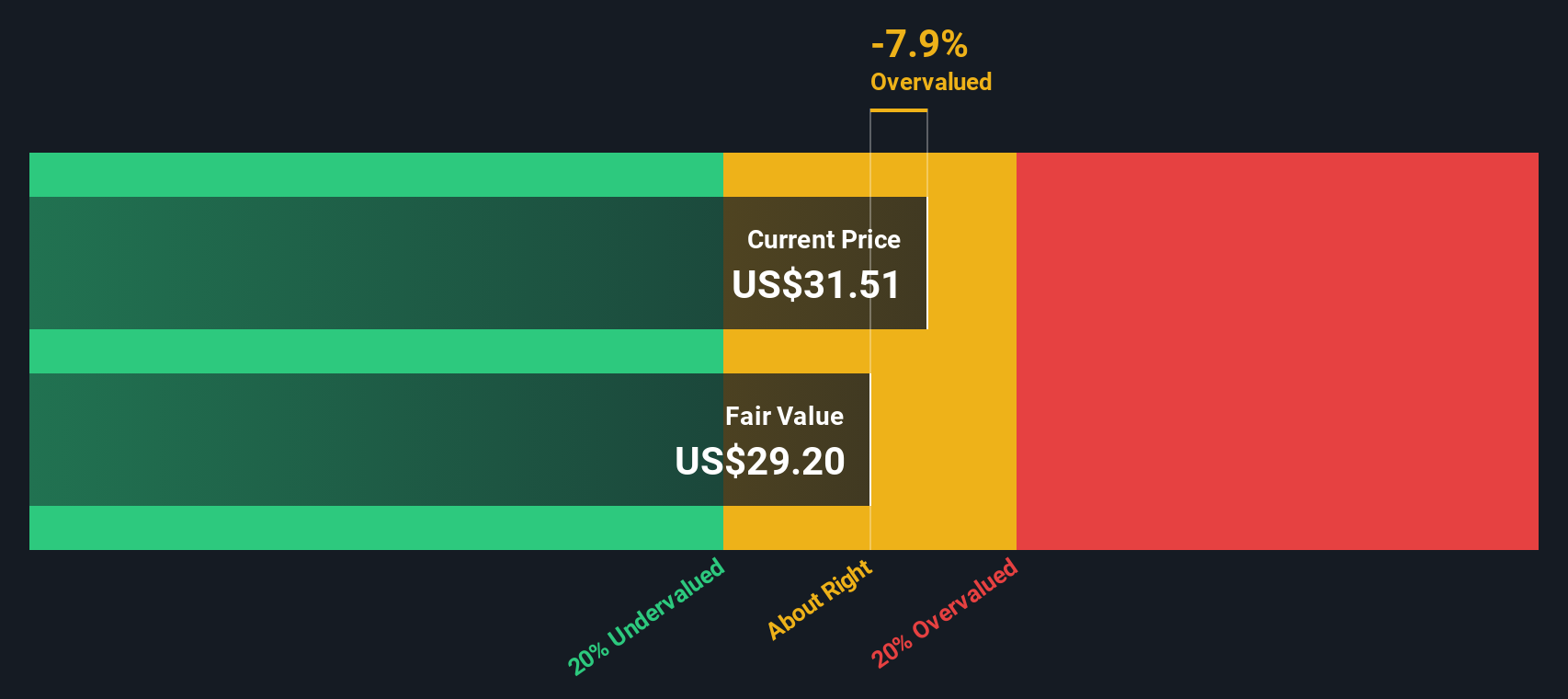

ACM Research (ACMR) is drawing investor attention due to upcoming earnings expectations of lower EPS but higher year-over-year revenue, prompting questions about the company's balance between expansion and earnings quality. This shift highlights concerns about profitability defense amid heavy investment in capacity and R&D. The article suggests exploring alternative perspectives and building an individual investment narrative, noting that current forecasts indicate a 25% downside to its fair value.

2026-02-13 18:58:20

This article analyzes ACM Research (ACMR) stock valuation using two methods. The Discounted Cash Flow (DCF) model suggests the stock is overvalued by 28.6% at $64.10 compared to an intrinsic value of $49.86 per share. However, when comparing its P/E ratio of 35.5x to its proprietary "Fair Ratio" of 40.3x, the stock appears undervalued, indicating that current pricing might reflect a mix of semiconductor equipment hype and long-term potential when considering different valuation perspectives.

2026-02-13 18:27:28

Renewed attention on ACM Research (ACMR) is driven by its SAPS and TEBO cleaning tools and their role with leading memory makers, especially considering the impact of U.S. sanctions on competitors in China. Despite significant share price increases and momentum, the stock is currently trading above an average analyst price target, leading to questions about whether the surge has run its course. While a discounted cash flow model suggests the stock is overvalued at $62.48 compared to a fair value of $48.67, its current P/E ratio of 34.6x is below that of its peers (53.9x) and a fair ratio of 38.7x.

2026-02-08 07:29:30

ACM Research's proprietary SAPS and TEBO cleaning technologies have granted it a quasi-monopoly in China's chip cleaning market due to U.S. sanctions on rival suppliers. While this position supports solid revenue growth and a push into new areas, the company's heavy reliance on China and export controls pose risks, despite recent share price gains indicating potential overextension. Investors are encouraged to consider diverse fair value estimates and build their own investment narrative.

2026-02-06 20:28:50

ACM Research (NASDAQ: ACMR) has set a preliminary transfer price of RMB 160.00 (approximately $23.05) per share for a planned sale of 4,801,648 shares of its operating subsidiary, ACM Research (Shanghai), Inc., on the Shanghai Stock Exchange. The price was determined through an inquiry-based quotation process involving 38 institutional investors. This follows a recent Q3 2025 earnings report where the company exceeded revenue forecasts but missed EPS expectations.

2026-02-03 20:59:13

ACM Research's operating subsidiary, ACM Research (Shanghai), Inc., has set a preliminary transfer price of RMB 160.00 (approximately $23.05) per share for a planned sale of 4,801,648 shares on the Shanghai Stock Exchange. This price was determined through an inquiry-based quotation process involving 38 institutional investors. This development follows the company's Q3 2025 earnings report, where EPS fell short of expectations ($0.36 vs. $0.55 projected), but revenue exceeded forecasts ($269.2 million vs. $252.2 million projected).