Arcosa Inc

$ 111.28

-1.14%

05 Mar - close price

- Market Cap 5,520,508,000 USD

- Current Price $ 111.28

- High / Low $ 112.20 / 108.98

- Stock P/E 37.27

- Book Value 53.91

- EPS 3.02

- Next Earning Report 2026-04-23

- Dividend Per Share $0.20

- Dividend Yield 0.18 %

- Next Dividend Date 2026-04-30

- ROA 0.04 %

- ROE 0.08 %

- 52 Week High 131.00

- 52 Week Low 67.96

About

Arcosa, Inc. provides infrastructure related products and solutions for the construction, energy and transportation markets in North America. The company is headquartered in Dallas, Texas.

Analyst Target Price

$127.83

Quarterly Earnings

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2026-02-26 | 2025-10-30 | 2025-07-30 | 2025-04-30 | 2025-02-20 | 2024-10-30 | 2024-08-01 | 2024-05-02 | 2024-02-22 | 2023-11-01 | 2023-08-03 | 2023-04-27 |

| Reported EPS | 1.15 | 1.56 | 1.27 | 0.49 | 0.46 | 0.91 | 0.91 | 0.73 | 0.68 | 0.73 | 0.76 | 1.06 |

| Estimated EPS | 0.9342 | 1.33 | 1.11 | 0.1843 | 0.89 | 0.86 | 0.83 | 0.52 | 0.49 | 0.67 | 0.59 | 0.55 |

| Surprise | 0.2158 | 0.23 | 0.16 | 0.3057 | -0.43 | 0.05 | 0.08 | 0.21 | 0.19 | 0.06 | 0.17 | 0.51 |

| Surprise Percentage | 23.1% | 17.2932% | 14.4144% | 165.8709% | -48.3146% | 5.814% | 9.6386% | 40.3846% | 38.7755% | 8.9552% | 28.8136% | 92.7273% |

Next Quarterly Earnings

| Mar 2026 | |

|---|---|

| Reported Date | 2026-04-23 |

| Fiscal Date Ending | 2026-03-31 |

| Estimated EPS | 0.574 |

| Currency | USD |

Previous Dividend Records

| Apr 2026 | Jan 2026 | Oct 2025 | Jul 2025 | Apr 2025 | Jan 2025 | Oct 2024 | Jul 2024 | Apr 2024 | Jan 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2026-04-30 | 2026-01-30 | 2025-10-31 | 2025-07-31 | 2025-04-30 | 2025-01-31 | 2024-10-31 | 2024-07-31 | 2024-04-30 | 2024-01-31 |

| Amount | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 | $0.05 |

Next Dividend Records

| Dividend per share (year): | $0.20 |

| Dividend Yield | 0.18% |

| Next Dividend Date | 2026-04-30 |

| Ex-Dividend Date | 2026-04-15 |

Recent News: ACA

2026-03-06 02:18:00

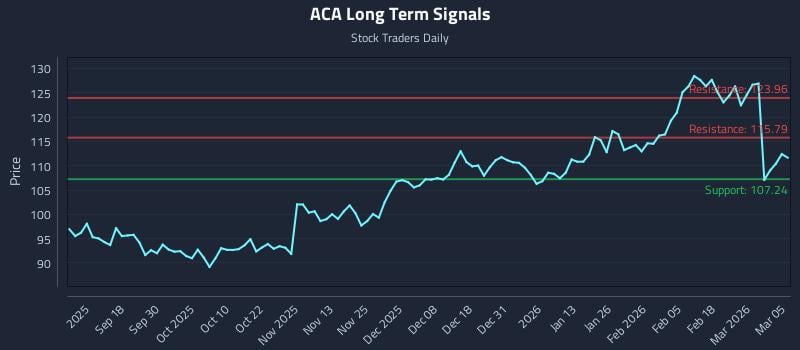

This article, featuring Arcosa Inc. (NYSE: ACA), analyzes volatility zones as tactical triggers for trading. It highlights a weak near and mid-term sentiment potentially challenging a long-term positive outlook, and details an exceptional 27.6:1 risk-reward setup. The analysis provides specific institutional trading strategies, including position trading, momentum breakout, and risk hedging, along with multi-timeframe signal analysis generated by AI models.

2026-03-05 15:51:52

Arcosa, Inc. (ACA) has shown unusual options activity, particularly with its April 17, 2026, $70.00 call option displaying high implied volatility, suggesting expectations of significant price movement. Despite this, analyst sentiment for Arcosa is bearish, with a Zacks Rank #4 (Sell) and recent downward revisions to earnings forecasts. This divergence might present a trading opportunity for experienced options traders who sell premium.

2026-03-05 08:52:56

Fisher Asset Management LLC increased its stake in Arcosa, Inc. (NYSE:ACA) by 23.3% in the third quarter, bringing their total ownership to 112,106 shares. Institutional investors collectively own 90.66% of the company's stock. Arcosa recently reported strong Q3 earnings, beating EPS estimates, and announced a quarterly dividend of $0.05.

2026-03-05 02:52:56

Arcosa recently reported strong Q4 2025 results, issued optimistic 2026 guidance, and announced the sale of its barge business for $450 million. These moves indicate a strategic shift towards focusing on construction materials and engineered structures, leveraging sale proceeds and earnings to fuel growth in infrastructure and power markets. While the outlook is positive, the article highlights the ongoing risk associated with Arcosa's dependence on government and public sector funding for major projects.

2026-03-03 21:51:58

Two industrial goods companies, Arcosa (ACA) and ArcBest (ARCB), recently received bullish ratings from analysts. D.A. Davidson maintained a Buy rating for Arcosa with a $125.00 price target, while Citi maintained a Buy rating for ArcBest with a $105.00 price target. Both companies are seen as "Moderate Buy" opportunities with upside potential by the analyst consensus.

2026-03-02 20:51:30

DA Davidson has increased its price target for Arcosa (NYSE:ACA) to $125.00 from $120.00, maintaining a "buy" rating on the stock, which suggests a potential upside of 12.87%. This adjustment follows Arcosa's recent earnings report where it surpassed EPS estimates with $1.15 per share against an expected $0.95, and revenue grew 7.6% year-over-year. Arcosa currently holds a "Moderate Buy" consensus rating among analysts, with an average target price of $120.00, while institutional investors own approximately 90.7% of the company's stock.