Airbnb Inc

$ 136.62

-0.15%

29 Dec - close price

- Market Cap 83,766,084,000 USD

- Current Price $ 136.62

- High / Low $ 137.16 / 136.16

- Stock P/E 32.58

- Book Value 14.16

- EPS 4.20

- Next Earning Report 2026-02-12

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA 0.07 %

- ROE 0.31 %

- 52 Week High 163.93

- 52 Week Low 99.88

About

Airbnb, Inc. (ABNB) is a pioneering online marketplace that has transformed the travel and hospitality sector since its founding in 2008 in San Francisco, California. By connecting travelers with a vast array of unique accommodations and authentic local experiences, Airbnb enriches consumer journeys, catering to the growing demand for distinctive travel options in a post-pandemic world. The company's innovative technology and strong commitment to community engagement enable it to adapt to evolving consumer preferences effectively. With a robust global footprint and a focus on enhancing interactions between guests and hosts, Airbnb is well-positioned to maintain its influential role in the reimagined tourism market.

Analyst Target Price

$140.23

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-06 | 2025-08-06 | 2025-05-01 | 2025-02-13 | 2024-11-07 | 2024-08-06 | 2024-05-08 | 2024-02-13 | 2023-11-01 | 2023-08-03 | 2023-05-09 | 2023-02-14 |

| Reported EPS | 2.21 | 1.03 | 0.24 | 0.73 | 2.13 | 0.86 | 0.41 | 0.76 | 6.63 | 0.98 | 0.18 | 0.48 |

| Estimated EPS | 2.32 | 0.94 | 0.24 | 0.58 | 2.13 | 0.91 | 0.23 | 0.62 | 2.15 | 0.78 | 0.1 | 0.33 |

| Surprise | -0.11 | 0.09 | 0 | 0.15 | 0 | -0.05 | 0.18 | 0.14 | 4.48 | 0.2 | 0.08 | 0.15 |

| Surprise Percentage | -4.7414% | 9.5745% | 0% | 25.8621% | 0% | -5.4945% | 78.2609% | 22.5806% | 208.3721% | 25.641% | 80% | 45.4545% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-02-12 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.66 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ABNB

2025-12-30 03:16:09

Booking Holdings (BKNG) shares closed nearly flat, influenced by late-December fund flows and thin liquidity, despite a $260 million weekly outflow from an ETF holding Booking. Investors are observing a Dec. 31 cash dividend and an estimated Feb. 19 earnings report. Analysts remain optimistic about resilient demand in online travel.

2025-12-24 20:09:12

The Bitwise MSTR Option Income Strategy ETF (NYSEARCA: ABNB) has declared a monthly dividend of $1.308 per share. This dividend is payable on January 2, 2025, to shareholders of record as of December 26, 2024, with an ex-dividend date of December 26, 2024.

2025-12-24 05:09:51

LogProstyle Inc. reported its fiscal results for the first half of FY2026, showcasing strong growth in its hospitality division despite a modest overall revenue decline. The company's hotel revenue increased by 10.7%, driven by higher occupancy rates and average daily rates, fueled by Japan's booming inbound tourism. LogProstyle is expanding its hotel portfolio, with a new property in Tokyo's Asakusa district slated to open in 2028, underscoring its commitment to sustainable growth in the Japanese tourism market.

2025-12-24 02:51:29

Booking Holdings (BKNG) is re-evaluating its valuation after increasing its cost-saving target to $550 million, partnering with viagogo, and facing a new legal challenge from a Berlin court. Despite these factors, the stock shows strong momentum with significant share price returns over the past three years. The narrative suggests BKNG is currently 12.4% undervalued, driven by AI integration, alternative accommodations, and loyalty program expansion, although geopolitical uncertainty and rising customer acquisition costs pose potential risks.

2025-12-23 15:08:15

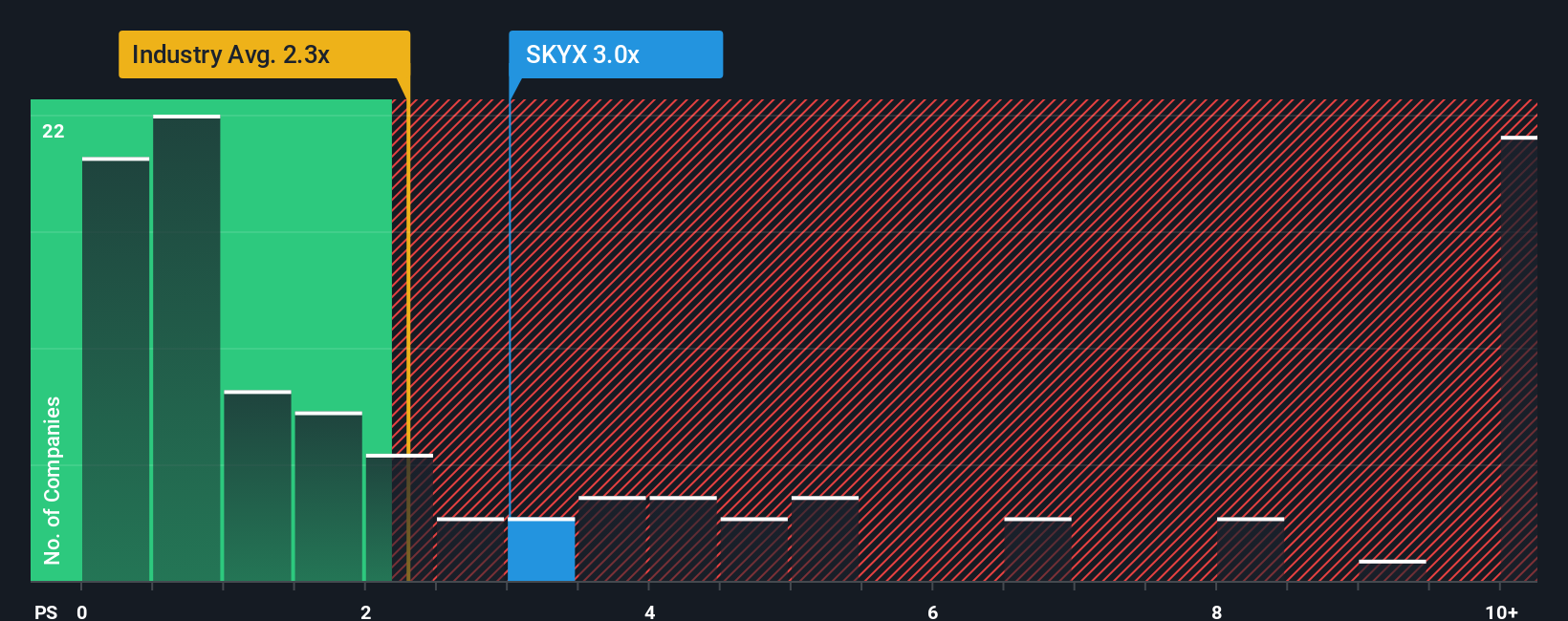

SKYX Platforms Corp. (NASDAQ:SKYX) has seen a significant 33% price gain in the last month, contributing to a 138% increase over the past year. Despite its 3x price-to-sales (P/S) ratio in an industry where nearly half of companies are below 2.3x, analysts forecast strong revenue growth of 26% per annum over the next three years, exceeding the industry average of 16%. This strong outlook on future revenues appears to be supporting its high P/S ratio.

2025-12-23 13:09:51

Reynolds Consumer Products recently exceeded quarterly revenue expectations and raised its guidance, yet its stock performance remains slightly negative in the short term. Despite a "14.2% Undervalued" narrative, driven by product innovation and demographic shifts, the article suggests potential for quiet re-rating if markets are not fully pricing in future growth. However, lingering raw material cost volatility and private label competition pose risks to margin expansion.