Atlantic American Corporation

$ 2.70

-1.46%

24 Feb - close price

- Market Cap 61,600,000 USD

- Current Price $ 2.70

- High / Low $ 2.78 / 2.70

- Stock P/E 30.20

- Book Value 5.20

- EPS 0.10

- Next Earning Report 2026-03-24

- Dividend Per Share $0.02

- Dividend Yield 0.67 %

- Next Dividend Date -

- ROA 0.01 %

- ROE 0.02 %

- 52 Week High 3.71

- 52 Week Low 1.23

About

Atlantic American Corporation provides life and health insurance and property and casualty products in the United States. The company is headquartered in Atlanta, Georgia.

Analyst Target Price

N/A

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-11-14 | 2025-08-13 | 2025-05-12 | 2025-03-25 | 2024-11-11 | 2024-08-14 | 2024-05-14 | 2024-03-22 | 2023-11-13 | 2023-08-08 | 2023-06-30 | 2023-03-28 |

| Reported EPS | 0.02 | 0.1523 | 0.0153 | 0.01 | -0.1028 | -0.0384 | -0.1141 | -0.1141 | 0.0762 | -0.0757 | -0.0757 | 0.0464 |

| Estimated EPS | None | None | None | 0 | None | None | None | 0 | None | None | None | 0 |

| Surprise | 0 | 0 | 0 | 0.01 | 0 | 0 | 0 | -0.1141 | 0 | 0 | 0 | 0.0464 |

| Surprise Percentage | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% | None% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-03-24 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | |

| Currency | USD |

Previous Dividend Records

| Apr 2025 | Apr 2024 | Sep 2023 | Apr 2022 | Apr 2021 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | Jan 1970 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Payment Date | 2025-04-23 | 2024-04-26 | 2023-09-12 | 2022-04-27 | 2021-04-27 | None | None | None | None | None |

| Amount | $0.02 | $0.02 | $0.02 | $0.02 | $0.02 | $0.02 | $0.02 | $0.02 | $0.02 | $0.02 |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: AAME

2026-02-19 10:28:26

Atlantic American (NASDAQ:AAME) saw its stock price drop below its 200-day moving average, trading as low as $2.74 before closing at $2.92. This move is significant as the 200-day moving average is a key technical indicator for long-term trends. Analysts currently have a "Hold" rating on the stock, which has a market capitalization of $59.57 million and limited institutional ownership.

2026-01-23 00:58:08

Atlantic American Corporation (NASDAQ:AAME) shareholders have experienced an 85% total shareholder return over the last year, despite an 11% drop in share price during the last quarter. The company transitioned from a loss to a profit in the past year, contributing to renewed investor confidence. This performance includes dividend payments, indicating an improvement in the stock's performance compared to its five-year average.

2026-01-17 06:57:18

Atlantic American Corporation (NASDAQ:AAME) saw a significant 28.3% drop in short interest in December, reducing it to 8,349 shares, representing a very low days-to-cover ratio of 0.2. Despite this, institutional ownership remains modest at 5.54%, with Citadel Advisors LLC recently acquiring a new position. The company's stock currently trades around $2.90, with a market capitalization of approximately $59.2 million and a P/E ratio of 13.18.

2026-01-03 09:09:25

Atlantic American (NASDAQ:AAME) saw its stock price drop below its two hundred day moving average of $2.70 on Friday, signaling a potential bearish trend. Despite this, the company has a market cap of $58.75 million, a P/E ratio of 13.09, and reported $0.02 EPS on $52.98 million revenue last quarter. Although institutional ownership is low at 5.54%, Teton Advisors recently acquired a stake, and analysts currently rate the stock as "Hold."

2025-12-26 18:09:31

Short interest in Atlantic American Corporation (NASDAQ:AAME) significantly increased by 227.6% to 11,646 shares as of December 15th, up from 3,555 shares on November 30th. This translates to a short-interest ratio of 0.5 days, reflecting a small fraction (0.3%) of the company's stock being short sold. Institutional ownership remains low at 5.54%, with Teton Advisors recently acquiring 19,000 shares, while the stock currently trades around $2.61 with a P/E of 11.86 and holds a "Hold" rating from analysts like Weiss Ratings.

2025-12-20 12:08:53

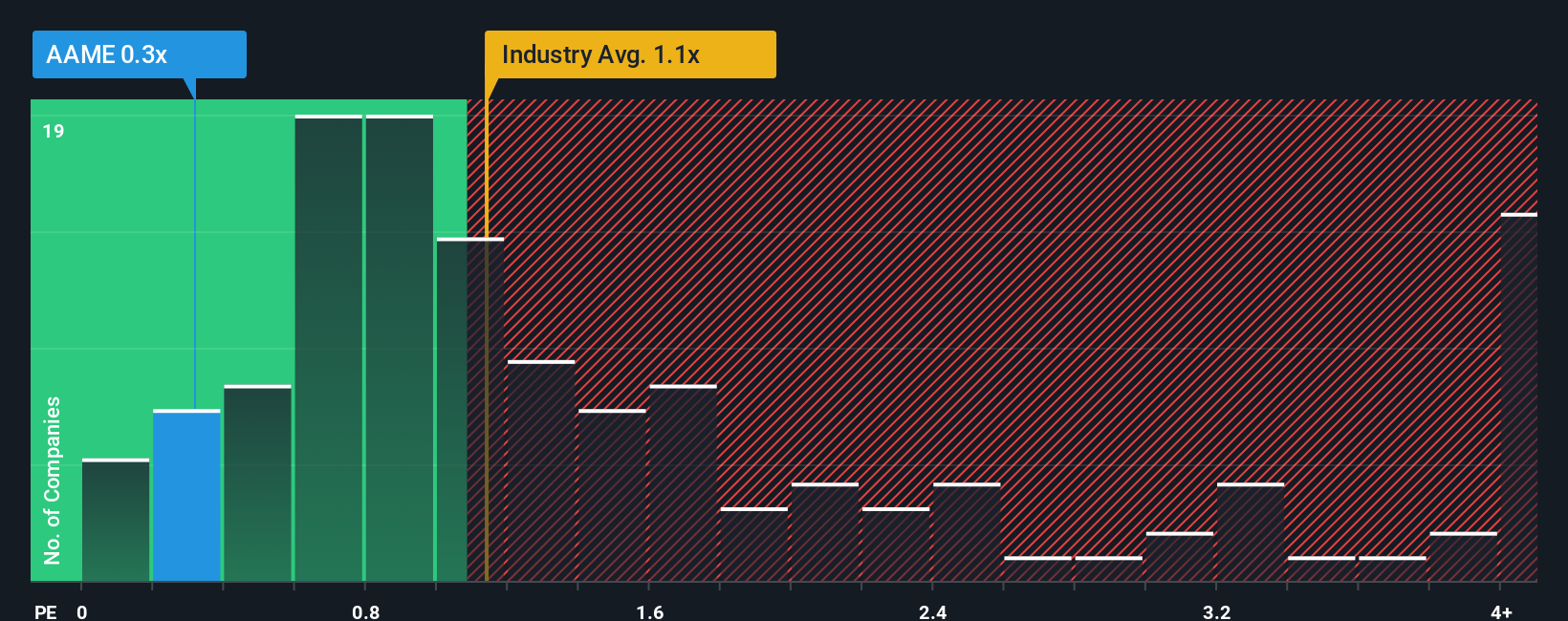

Atlantic American Corporation's stock has rebounded 39% in the last month, contributing to a 118% annual gain, yet its P/S ratio of 0.3x remains low compared to the industry average of 1.1x. Despite recent revenue growth, investors seem unconvinced, suggesting concerns that the company's performance might underperform the broader insurance industry. The P/S ratio does not fully reflect the company's solid revenue growth over the past one to three years, indicating potential unobserved threats or bearish sentiment among shareholders.